By selecting an indicator of your interest, information will be displayed below:

General Indicators

Corporate Governance

Corporate Profile

Ethics and Integrity

Reporting practice

Stakeholder engagement

Strategy

Material Topics

Business development and Economic performance

Climate Change Risk Management

Commitment and Working Environment

Community Engagement

Customer Health and Safety

Environmental Management and Operating Efficiency

Ethics and anticorruption

Innovation in products and processes

Occupational Health and Safety

Supply Chain Management

417-3. Incidents of non-compliance concerning marketing communications

This year, one incident of non-compliance with marketing communications was reported, due to the placement of suspension stamps in three advertising locations for McCormick brand teas. The advertising was withdrawn from all the hoardings and the authority issued a single minor penalty.

417-1. Requirements for product and service information and labeling

Our labels are the main form of communicating the most important information about our products to our customers. This information includes the origin of the product's components, nutritional information—especially saturated fats, sugars, sodium and calorie content—net content, safety instructions and the best way to dispose of or recycle the packaging. We make an exhaustive inspection of the ingredients that go into our different products to ensure they comply with the applicable regulations, both locally and, where appropriate, in the country to which they are exported.

Labeling, as such, is not directly related to environmental or social impact, but there are other procedures for withdrawing a product from the market which address that situation. All our labels meet the regulations applicable in the country of destination. In the case of Mexico, all are designed in accordance with Sanitary Control Regulations for products, NOM-050-SCFI-2004: Commercial Information; General Product Labeling and NOM-051-SCFI/SSA1-2010: General labeling specifications for pre-packaged food and non-alcoholic beverages-Commercial and sanitary information.

416-2. Incidents of non-compliance concerning the health and safety impacts of products and services

During 2018, 1 case was presented regarding the health and safety of our products.

At our Galerías Atizapán, Estado de México branch, product was immobilized for having expired. A non-significant penalty was paid.

103-5. Management Approach

Our broad portfolio of brands and strict parameters on quality and harmlessness promote a healthy lifestyle for our clients and consumers. Our labeling, based on the best national and international practices, communicates graphically and effectively the nutritional content and energy contribution of each of our products, enabling our customers and consumers to make informed decisions.

103-11. Management Approach

Through the unification of strategies and continuous improvement processes, managed by the Environmental Control, Safety and Hygiene (CASH for its initials in Spanish) area, we safeguard the integrity and wellbeing of our employees; we prevent and mitigate incidents that affect the environment, and maintain a culture of safety and risk prevention, thereby ensuring the continuity of our operations.

Our Industrial Safety Policy can be found at https://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/

103-9. Management approach

Innovation is one of the five strategic pillars upon which we have built sustainable and responsible growth over more than 100 years. A decisive factor in that growth has been the ability to clearly understand the present and future needs of our clients and consumers and provide solutions with unique value through our extensive and growing portfolio of products and services.

Through a continuous creation process and idea-to-launch methodology, our innovation area conceptualizes, develops and markets our products and services, allowing us a culture of disruptive product innovation, to position as customer-focused, high performance leaders and to anticipate and manage market risks and thus transform quickly, profitably and successfully.

The Company stays abreast of the nutritional needs of the national population and international markets, in order to provide increasingly healthier products for consumers.

409-1. Operations and suppliers at significant risk for incidents of forced labor

Our Supplier Code of Conduct contains the minimum requirements for our current and potential suppliers in terms of the social and environmental conditions for the development of their operations and services. The document is based on the standards of the International Labor Organization (ILO), the ten principles of the United Nations Global Compact, and the Human Rights Policy and Code of Ethics of Grupo Herdez, which establishes that Grupo Herdez rejects, without exception, all forms of forced or compulsory labor, any form of child labor for whatever purpose, whether full or part time, including remunerated or otherwise.

408-1. Operations and suppliers at significant risk for incidents of child labor

We maintain strict control over our hiring processes on fishing vessels and have a purchasing policy and supplier code containing clauses that prohibit the hiring of suppliers who employ child labor or forced labor. This measure avoids the risk of employing child labor throughout our value chain, especially in the most vulnerable sectors like agriculture and fishing. The Supplier Code of Conduct can be found at: https://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/

204-1. Proportion of spending on local suppliers

Grupo Herdez defines local or national suppliers as those with manufacturing and transformation facilities located in Mexican territory.

Raw Materials

Only 8.15 percent of non-perishable raw materials is purchased from foreign suppliers, equivalent to $356,074,738,* the remaining 91.85 percent, equivalent to $4,014,048,610 goes to domestic purchases.

* Soy bean comes under domestic purchases since although its main origin is the United States, the end product--soy oil--is refined in Mexico.

Packaging Material

74.6 percent of total spending on packaging materials goes to domestic suppliers, which is the equivalent of $2,085,519,706.27, 4.1 percent goes to foreign suppliers, the equivalent of $114,788,832.45 and 21.3 percent goes to a mix of domestic and foreign supply, equivalent to $595,293,389.9.

* A large part of the raw packaging materials (resins, special substrates, adhesives, tinplate, among others) is of foreign origin, however, it is transformed in Mexico, particularly the manufacture of pulp and paper for corrugated cardboard. Imported materials are purchased only in the event of shortage.

Agricultural Supply

All our agricultural producers operate in Mexico, with operations throughout the Mexican Republic, in Aguascalientes, Baja California, Baja California Sur, Chihuahua, Mexico City, Durango, Guanajuato, Hidalgo, Morelos, Nayarit, Nuevo León, Puebla, San Luis Potosí, Sinaloa, Sonora and Zacatecas.

In 2018, the purchase of agricultural inputs represented an investment of $823,000,000.

*Figures expressed in Mexican pesos (MXN).

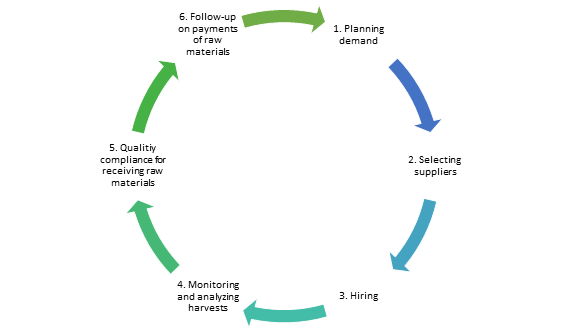

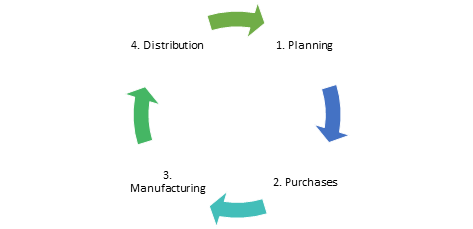

103-3. Management approach

Strategic Supply

Our supply chain consists of all the activities we use to get our products and services onto the tables of clients and consumers with their characteristic reliability and quality. We work under four strategic pillars: utility, innovation, productivity and risk management, an approach which enables us to ensure the supply of necessary resources for our present and future operations and to establish mutually valuable relationships with our suppliers.

Similarly, through the Supply area and by following the guidelines of the Carbon Disclosure Project, we constantly monitor the impact of our consumption of raw materials that are highly vulnerable to environmental and forest risks, such as soy oil, and wood.

Agricultural Supply

Our agricultural supply area is responsible for ensuring the quality and traceability of all our agricultural products. We achieve this along three pillars: supply, supplier development and agricultural auditing.

The care, development and monitoring of all our agricultural suppliers, is key to achieving an efficient and responsible value chain.

415-1. Political contributions

In compliance with our Code of Ethics, which requires a strictly neutral stance in matters of politics and religion, Grupo Herdez and its subsidiaries make no financial and/or in-kind contributions to political parties or related institutions; nor does it receive financial assistance from the government. The Group has an Ethics Committee made up of a team of six members from different areas, who join forces with our directors to provide guidance in favor of ethical and lawful conduct. Our Code of Ethics can be found at: https://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/

206-1. Legal actions for anti-competitive behavior, anti-trust, and monopoly practices

In 2018, there were no complaints of monopoly or unfair practices. However, despite there being no cases of this kind in recent years, the Anti-trust and Economic Competition Policy was adopted in 2018 and can be found at: https://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/

205-3. Confirmed incidents of corruption and action taken

Incidents related to non-compliance with the Code of Ethics on topics of corruption and breach of human rights are reported confidentially through the Ética Herdez line. The line is monitored by an external supplier, which periodically shares a consolidated report with the management of Human Resources and the general management of Internal Audit; Internal Audit is responsible for following up and investigating all complaints and making a decision which may range from a verbal or written reprimand to dismissal and legal action.

Taking this procedure into account, during 2018:

- Six cases of corruption were confirmed: 2 related to breach of confidence by accepting gifts or gratuities, 1 for conflict of interest by being related to the client, 1 for product theft, 1 for improper use of fuel card resources and 1 for improper authorization of finished product without charge to the customer.

- In addition, 13 employees were dismissed from the Company pursuant to complaints.

103-1. Management Approach

In Grupo Herdez we continue to work on strengthening a culture of legality with the workers, clients, suppliers and institutions with whom we work, reinforcing year after year the knowledge and diffusion of our Code of Ethics and grievance mechanisms. Through training sessions, communication campaigns and initiatives we strengthen the standards and values under which we operate, thus encouraging ethical behavior in our value chain.

Furthermore, we recognize the importance of having employees and strategic partners who share our integral approach to ethics, allowing us to have regulatory agents that reject and denounce illegal acts, such as corruption, bribery and any breach of human rights; key social issues which we are facing every day and which prevent us from having fair, peaceful and inclusive societies.

103-7. Management approach

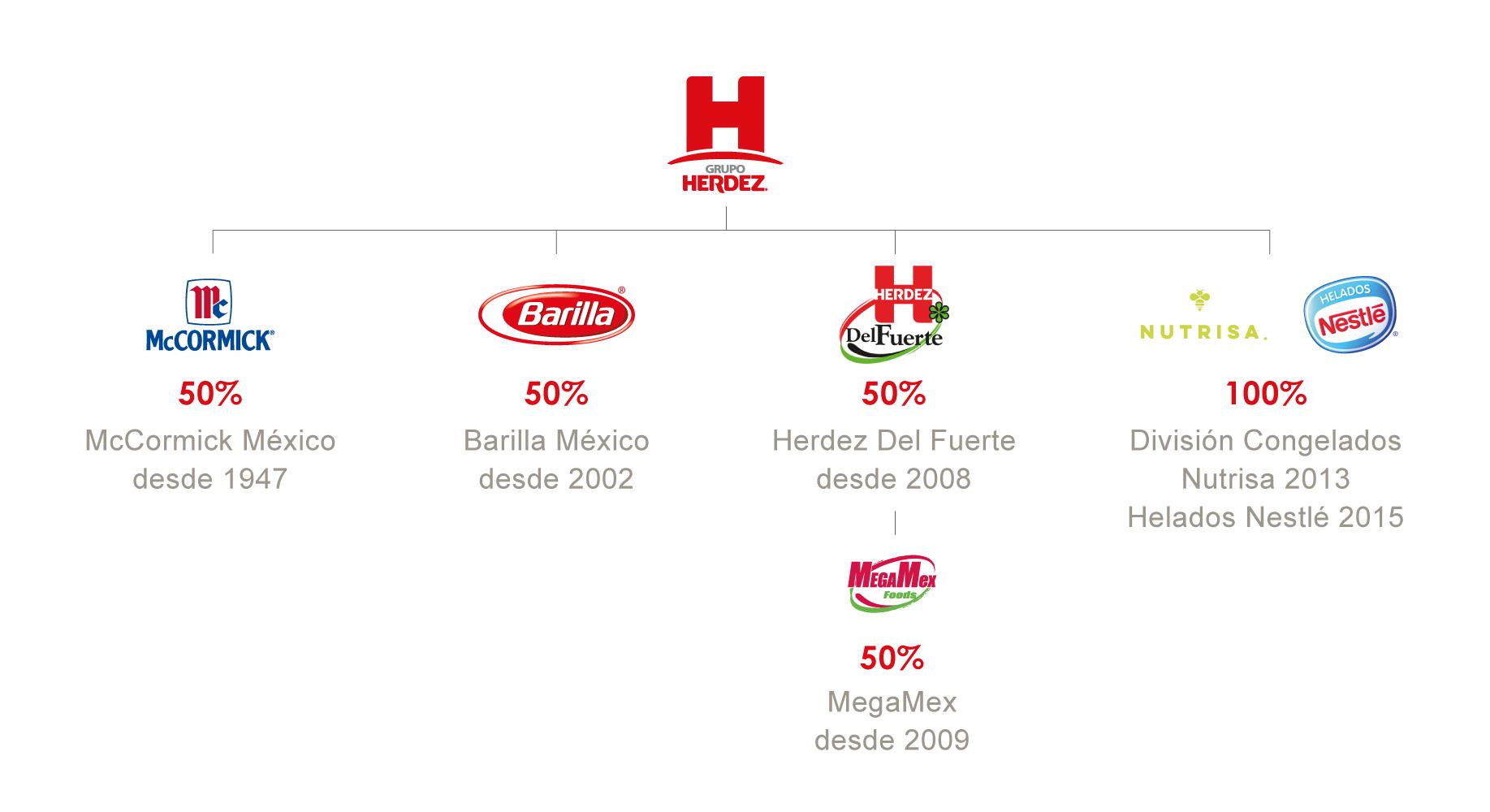

Through the detection and management of new business opportunities, constant innovation, brand diversity, strategic distribution alliances and proper management of environmental and social resources, we have been able to overcome a constantly shifting market, uncertain economic scenarios and other challenges to achieve steady growth and cross borders. Furthermore, having a sustainability strategy aligned with the Sustainable Development Goals, together with our environmental and social efforts, we have positioned as one of the leading processed food companies, one of the major players in the ice cream segment in Mexico, and among the leaders of the Mexican food segment in the United States, as well as being present in 21 countries around the world.

406-1. Incidents of discrimination and corrective actions taken

In 2018, we gave the workshop "Promoting a culture of legality in the workplace" as part of the business strategy to reinforce our Culture of Ethics and strengthen the Culture of Legality issues. Any form of harassment or discrimination due to ethnic origin, religion, nationality, gender, sexual preference, marital status, age, disability or for any other reason is prohibited across all our working activities. Our Code of Ethics and other Policies can be found at: https://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/

During 2018, there were no cases of discrimination and/or harassment.

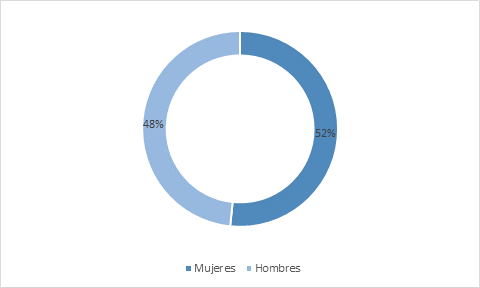

401-3. Parental leave

During 2018, 133 employees were given parental leave; 100 women and 33 men. Of these employees, 112 have returned to work after their leave and continue to work in the company 12 months later.

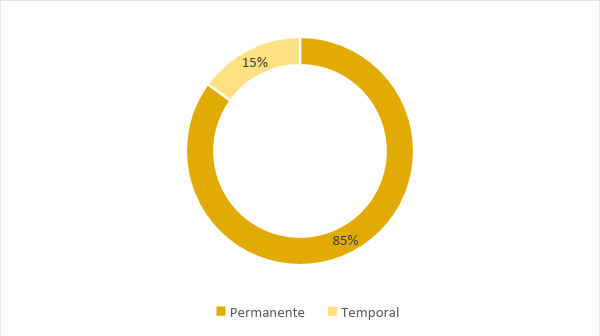

103-12. Management Approach

One of Grupo Herdez' priorities is to provide a working environment where our employees can develop their personal and professional abilities to the full. It is, therefore, highly important to attract, develop and retain the best talent, through training plans, ongoing development and feedback, merit awards, respect for collective bargaining and a culture of ethical performance.

102-56. External assurance

For the fifth consecutive year, our sustainability information has been audited by Ernst & Young México (EY). (Añadir link a carta de verificación)

102-54. Claims of reporting in accordance with the GRI Standards

The sustainability information has been compiled in accordance with the Global Reporting Initiative (GRI) Standards, Core option, the Sustainable IPC of the Mexican Stock Exchange, the principles of the United Nations Global Compact and the United Nations Sustainable Development Goals.

It should be mentioned that the report covers all the Group's strategic areas and that the information contained therein was obtained through the social responsibility committees, key areas and senior management, who provided consolidated data for each indicator.

102-53. Contact point for questions regarding the report

Corporate Offices

Monte Pelvoux 215, Col. Lomas de Chapultepec, Del. Miguel Hidalgo, C.P. 11000.Mexico City.

Telephone: +52(55) 5201-5655

Contact: Grecia Domínguez Leyva

102-52. Reporting cycle

Year after year, our integrated sustainability report presents the results, programs and actions in the areas of finance, social and environment that took place during the period.

102-51. Date of most recent report

The most recent previous report covered the most important events from January 1, 2017 to December 31, 2017.

102-50. Reporting period

The scope of the information in this report is from January 1, 2018 to December 31, 2018.102-49. Changes in reporting

This year, due to the traceability of information we are not reporting the total volumes of our packaging materials.

This year, we are incorporating agricultural supply information into the supply chain information, as total volume of raw materials acquired throughout the year and the total number of suppliers.

In the environmental topic, this year's report includes consolidated information from previous years to enable the reader to identify and understand the performance in 2018 compared to previous years.

We updated the Health and Safety at Work indicators and Water indicators in accordance with the GRI 2018 update.

102-48. Restatements of information

There were no restatements of information.

102-46. Defining report content and topic Boundaries

In 2016, using GRI methodology and by involving our main stakeholders—suppliers, employees and customers—in interviews, focus groups and scoring on a scale of 1 to 5, we updated our materials study to identify the topics with greatest impact by and on the company.

In 2018, we continued to work on the priority topics detected during 2016: ethics and anti-trust, risk management, supply chain management, environmental management and operating efficiency, customer health, legal compliance, business development, economic performance, innovation, product labeling, occupational health and safety, commitment and working conditions, and community engagement.

Also, during 2018, we held dialog sessions with the employees responsible for following up on each material topic to establish the management approach (DMA) for each one. These meetings addressed the how, why and what we are doing to mitigate the negative and enhance the positive impacts.

The results of the meetings can be found in the management approaches of each section within the GRI content index.

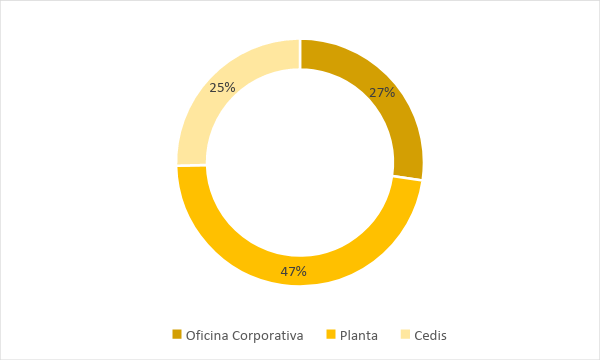

102-7. Scale of the organization

The Group's infrastructure comprises:

15 plants (13 in Mexico, one in the United States and one in Peru)

24 distribution centers (22 in Mexico and 2 in the United States)

7 tuna vessels

479 Nutrisa stores

9,762 employees

20,971 mp in Net Sales

3,517 mp EBITDA

2.2% of Net Profits in Social Investment

* mp: Million pesos

The Company was founded in 1914 and has been listed on the Mexican Stock Exchange since 1991 under the symbol HERDEZ * and on the OTC under the symbol GUZBY (Level 1 ADR).

102-6. Markets served

We are present in 21 countries in 6 different regions around the world:

North America

- Mexico

- United States

- Canada

Central America

- Guatemala

- El Salvador

- Honduras

- Nicaragua

- Costa Rica

- Ecuador

Caribbean

- Cuba

- Dominican Republic

- Jamaica

- Aruba

Europe

- Spain

- Germany

- Portugal

- Switzerland

- Czech Republic

- Russia

Oceania

- New Zealand

Asia

- South Korea

102-5. Ownership and legal form

We are a mercantile company which has traded on the Mexican Stock Exchange since 1991 under the symbol HERDEZ*, and since 1997 on the OTC market under the symbol GUZBY. We are also one of 30 companies that form part of the Sustainable Price and Quotations Index, which recognizes those companies with the best social, environmental and corporate governance practices.

102-4. Location of operations

We are present in 21 countries in 6 different regions around the world:

North America

- Mexico

- United States

- Canada

Central America

- Guatemala

- El Salvador

- Honduras

- Nicaragua

- Costa Rica

- Ecuador

Caribbean

- Cuba

- Dominican Republic

- Jamaica

- Aruba

Europe

- Spain

- Germany

- Portugal

- Switzerland

- Czech Republic

- Russia

Oceania

- New Zealand

Asia

- South Korea

102-3. Location of headquarters

Our corporate offices are at Monte Pelvoux 215, Lomas de Chapultepec, Ciudad de México, C.P. 11000.

102-2. Activities, brands, products, and services

We are leaders in the processed food sector and one of the main players in the ice cream category in Mexico, and among the leaders in the Mexican food segment in the United States.

We participate in a wide range of categories, including organic foods, tuna, burritos, ketchup, spices, guacamole, ice cream, mayonnaise, jam, honey, mole sauce, mustard, pasta, tomato puree, home-style salsas, tea and canned vegetables.

We sell our products through a portfolio of exceptional brands, which include Aires de Campo®, Barilla®, Búfalo®, Chi-Chi’s®, Del Fuerte®, Don Miguel®, Doña María®, Embasa®, Helados Nestlé®, Herdez®, La Victoria®, McCormick®, Nutrisa®, Wholly Guacamole® and Yemina®.

In addition, we have product distribution agreements in Mexico with Frank's®, French's®, Kikkoman®, Ocean Spray® and Reynolds®.

102-14. Statement from senior decision-maker

Message from the Chief Executive Officer and Chairman of the Board Read more

102-13. Membership of associations

Industry

- Mexican Association of the Coffee Production Chain (Asociación Mexicana de la Cadena Productiva del Café, AMECAFE)

- National Chamber of Metal Can Manufacturers (Cámara Nacional de Fabricantes de Envases Metálicos, CANAFEM)

- National Chamber of the Food Preserves Industry (Cámara Nacional de la Industria de Conservas Alimenticias, CANAINCA)

- Mexican Council of the Consumer Products Industry

- Mexican Council of the Consumer Products Industry (CONMEXICO)

- National Agricultural Council (Consejo Nacional Agropecuario, CNA)

- National Council of Organic Production (Consejo Nacional de Producción Orgánica, presided over by SAGARPA)

- International Federation of Organic Agriculture Movements (IFOAM)

- Mexican Organic Movement (Movimiento Orgánico Mexicano)

Business

- Mexican Association of Electronic Business Standards (Asociación Mexicana de Estándares para el Comercio Electrónico, AMECE)

- Foreign chambers of commerce: Canadian, British, Spanish and American

- Confederation of Industrial Chambers (Confederación de Cámaras Industriales, CONCAMIN)

- Business Coordinating Council (Consejo Coordinador Empresarial, CCE)

Sustainability

- Mexican Center for Philanthropy (Centro Mexicano para la Filantropía)

- Private Sector Study Commission for Sustainable Development (Comisión de Estudios del Sector Privado para el Desarrollo Sustentable, CESPEDES)

- Business Commitment for the Integral Management of Solid Waste (Compromiso Empresarial para el Manejo Integral de Residuos Sólidos)

- Basin Councils (Consejos de Cueca, in CONAGUA)

- ECOCE, A.C.

- Iniciativa GEMI

- United Nations Global Compact

102-11. Precautionary Principle or approach

Grupo Herdez is currently engaged in an Organizational Life Cycle Assessment (LCA) to calculate the environmental footprint of its main product categories. The aim is to detect opportunities to reduce environmental impacts in the supply chain and create synergies with the external actors and Stakeholder groups that intervene in our chain of production. The results of the LCA will be used to develop an action plan--with short, medium and long-term horizons--prioritizing the projects with greatest impact and taking into account the following criteria: reducing the environmental footprint, profitability for the business and ease of implementation.

Grupo Herdez, aware of the environmental, safety and quality risks that may arise in the framework of its operations and to ensure that its impacts on society and the environment are positive, approaches the precautionary principle (environmental, safety and quality risks) in two stages

Internally, through the Environmental Control, Safety and Hygiene (CASH) area, whose aim is to safeguard the integrity of employees and facilities, support operating continuity through compliance with applicable regulations and collaborate in the protection of assets.

Each of our locations has a work program aligned with the goals of Grupo Herdez for CASH; the program is based on risk studies and backed by safety and hygiene regulations to measure risks pertaining to machinery, equipment, storage, chemical control, work environment, noise, and high and low temperatures.

Preventive Plans

We have a World Class Manufacturing (WCM) scheme, whose goal is continued improvement across all our plants. This program has helped us to:

- Achieve competitive costs.

- Improve productivity.

- Have a quality reference.

- Attain world class management and operation.

- Have effective information systems.

Similarly, we have a major emergency plan, designed to respond to any contingency in plants and distribution centers. The plan involves brigades which support and coordinate communication between affected, adjoining and corporate areas. Five contingencies arose in 2017.

Membership in Associations

We participated in Coparmex as a consultant and adviser on safety and hygiene and environmental matters, and were active members of the CONMEXICO safety committee.

Certifications

Environment

- Clean Industry Certification, issued by the Federal Environmental Protection Agency (PROFEPA). In 2018, we maintained our certification in 4 plants.

- Marine Stewardship Council Certification, which establishes the standards for sustainable fishing and traceability of sustainable fishing products.

Safety

- Safe Industry certification issued by the Secretariat of Labor and Social Welfare (STPS).

Quality

- Certification issued by the Federal Commission for Protection against Health Risks (COFEPRIS).

Civil Protection

- Every year, an internal protection program is run, audited by internal personnel and focused on the prevention of fire, spills, leaks and other risks.

102-10. Significant changes in the organization and its supply chain

In September 2018, a new Distribution Center was opened in Villahermosa, Tabasco, with a surface area of 6,000 square meters and the capacity for 6,000 pallets.

102-1. Name of the organization

Grupo Herdez, S.A.B. de C.V.

102-42. Identification and selection of stakeholders

Stakeholders are defined as those main internal and external actors with whom we have established a close win-win relationship that fosters the growth and sustainable development of both parties.

102-36. Process for determining remuneration of the highest governance body

The Corporate Practices Committee is responsible for validating the remuneration of the Company’s senior executives, including the Chief Executive Officer.

102-35. Remuneration policies for the highest governance body

In accordance with Company bylaws, the remuneration received by Board members is three 50-peso gold coins (centenary commemoration coins) or their equivalent for attending each meeting; this remuneration is not dependent on the Group’s profits.

102-31. Review of economic, environmental and social topics

The Board meets quarterly and has intermediate bodies in charge of overseeing the management and execution of the Company’s objectives. A sustainability performance report is presented during the board meetings, which covers environmental performance and quality of life indicators for employees.

102-29. Highest governance body’s role in identifying and managing economic, environmental and social topics and their impacts, risks and opportunities

The Board meets quarterly and has intermediate bodies in charge of overseeing the management and execution of the Company’s objectives. A sustainability performance report is presented during the board meetings, which covers environmental performance and quality of life indicators for employees.

102-26. Role of highest governance body in setting purpose, values and strategy

The Board meets quarterly and has intermediate bodies in charge of overseeing the management and execution of the Company’s objectives. A sustainability performance report is presented during the board meetings, which covers environmental performance and quality of life indicators for employees.

102-25. Conflicts of interest

Each Board member signs a declaration of absence of conflict of interest, and each Committee has regulations that establish its functions and relationship with the Board of Directors.

Furthermore, our Code of Ethics and Conflict of Interest Policy are binding documents and obligatory for all employees. They can be viewed at: https://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/102-24. Nominating and selecting the highest governance body and its committees

Board members are ratified by shareholder vote at the Annual Meeting. To be selected, Board members must meet the following requirements:

i) professional training in economic-administrative sciences, preferably with a master’s degree in those areas; ii) twenty years’ minimum professional experience in executive positions with consumer companies and/or the finance sector; iii) experience as a board member in manufacturing industry companies and/or the finance sector; and iv) belong to business organizations.102-23. Chair of the highest governance body of the organization

The Chairman of the Board, Héctor Hernández Pons Torres, is also the Chief Executive Officer.

102-21. Consulting stakeholders on economic, environmental and social topics

In 2016, using GRI methodology and by involving our main stakeholders—suppliers, employees and customers—in interviews, focus groups and scoring on a scale of 1 to 5, we updated our materials study to identify the topics with greatest impact by and on the company. In 2018, we continued to work on the priority topics detected during 2016: ethics and anti-trust, risk management, supply chain management, environmental management and operating efficiency, customer health, legal compliance, business development, economic performance, innovation, product labeling, occupational health and safety, commitment and working conditions, and community engagement.

102-20. Executive-level responsibility for economic, environmental and social topics

During the quarterly Board meetings, a sustainability performance report is presented, which includes environmental performance and quality of life indicators for collaborators. The board members responsible for the report are:

Labor Practices: José Manuel Rincón Gallardo

Environmental Practices/Climate Change: Luis Rebollar Corona

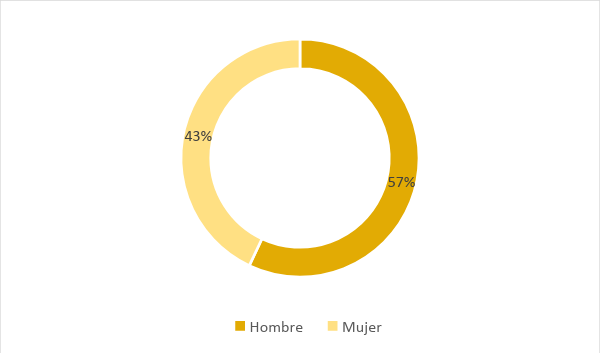

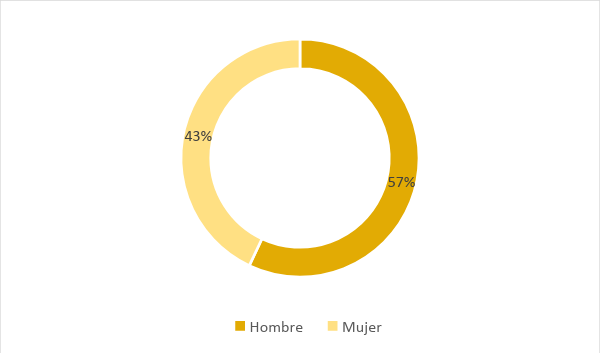

Corporate Governance: José Roberto Danel DíazAll Board members are over 50 years and 78% are men.Furthermore, in 2016, Grupo Herdez set up an Energy Committee, which is comprised of directors from the different areas of the Company, including the Chairman of the Board. The committee is responsible for defining the strategic goals in terms of energy, such as: energy procurement, cogeneration, efficiency projects, etc., and meets twice a year.

102-19. Delegation of authority

During the quarterly Board meetings, a sustainability performance report is presented, which includes environmental performance and quality of life indicators for collaborators. The board members responsible for the report are:

Labor Practices: José Manuel Rincón GallardoEnvironmental Practices: Luis Rebollar CoronaCorporate Governance: José Roberto Danel Díaz.

Ninety percent of board members are over 50 years and 78% are men.

102-17. Mechanisms for advice and concerns about ethics

All levels of authority within the company and stakeholder groups, including suppliers and employees, are governed by our codes and policies (http://grupoherdez.com.mx/sustentabilidad/codigos-y-politicas/), which are constantly reinforced through training sessions, communications and meetings.

To prevent any kind of unethical behavior or situation which undermines the integrity of our employees and/or suppliers, and consequently the company, we have grievance mechanisms that are monitored by an external supplier, and assessed by the internal audit team and the Human Resources Department.

Our internal stakeholders can file complaints through:

- E-mail: [email protected], [email protected]

- E-mail and direct line to the supervisors of Human Resources, Internal Audit and Legal.

- Physical mailboxes inside different locations

- Toll-free line 01 800 CONFIANZA (01 800 266 342 692) or (Nutrisa 01800 312 98 32)

These mechanisms are available 365 days a year, 24 hours a day.

The most used mechanism is the 01 800 confianza line which received more than 60 percent of the grievances or complaints filed; during 2018, 22 grievances and 81 complaints were received, of which 93 percent have been resolved, the remaining 7 complaints were made in the 4th quarter of 2018 and are in the process of being dealt with.

102-16. Values, principles, standards and norms of the organization

Mission

To place quality foods, beverages and products within the reach of consumers, under brands of growing prestige and value.

Vision

Grupo Herdez aims to consolidate, grow and position itself as a leading company in the food, beverage and wellness products industry, recognized by the quality of its products and the effectiveness of its efforts in satisfying the clients' and consumers' needs and expectations, within a framework of optimal consumer care and service, under strict profitability criteria, strategic potential and sustainability.

Values

Honesty, Achievement Focus, Team Work and Trust.

IP-2. Percentage of operations with implemented community engagement, impact assessments and development programs

Community Engagement Chapter Read more

103-10. Management approach

Grupo Herdez is committed to the social and environmental needs of the places where we operate, and we strive to make our programs and projects increasingly aligned with a vision of sustainability. That is why we are perfecting our strategy and we present the alignment of our four action pillars with 7 Sustainable Development Goals, in order to make a positive contribution to the 2030 Agenda proposed by the United Nations. One of our main commitments, and the most important to us, is Zero Hunger.

In addition to the above, due to our business activity as a leading company in the food, beverage and wellness product sector, we focus our sustainability and social responsibility efforts on contributing to food security in Mexico. Therefore, we improve the bioavailability of nutrients, contributing to healthy and affordable nutrition, and mitigating food waste through two central programs: generating and installing productive projects in rural communities through the Saber Nutrir program, in partnership with associations such as ChildFund and Pro Mazahua. We also make a monthly food donation to the Mexican Food Bank, an association that provides food to populations living with food poverty across the nation.

All of our community outreach and support programs are intended to improve the quality of life and nutritional condition of their beneficiaries.

IP-1. Customer and client relations

To address the comments and needs of our customers and consumers, we have various means of communication.

Points of contact

01-800 Lines: each brand has an assigned number for resolving problems with quality, complaints, or product suggestions. This year we received a total of 737 calls and 947 e-mails. Each one generates a follow-up report, and in case of product complaints, we also track their status and/or resolution process.

Digital methods: we have official websites for most of our brands, where consumers and customers may find all of the related information. We also have more than 20 profiles on brand social networks, where the interaction of “Q & A” allows us to monitor our successes, concerns and questions from our customers.

www. | YouTube | Other | ||||

Grupo Herdez | X |

| X | X |

|

|

Aires del Campo | X | X | X |

| X | 1 |

Barilla | X | X | X | X |

|

|

Blasón | X | X |

|

| X |

|

Búfalo | X | X | X | X | X |

|

Carlota | X |

|

|

|

|

|

Chi-Chi's | X | X |

|

| X |

|

Del Fuerte | X | X |

| X |

|

|

Don Miguel | X | X |

|

|

|

|

Doña María | X | X |

|

|

|

|

Herdez | X | X |

|

|

| 1 |

McCormick | X | X |

| X |

|

|

Helados Nestlé |

| X |

|

| X | 2 |

Herdez Brand | X | X |

|

|

| 1 |

Nutrisa | X | X | X |

| X |

|

Vesta |

|

|

|

|

|

|

La Victoria | X | X | X | X | X | 2 |

Wholly Guacamole | X | X | X | X | X | 2 |

Yemina | X |

|

|

|

|

|

Distribution Agreements | ||||||

Kikkoman México | X | X |

| X |

|

|

Ocean Spray | X | X |

|

|

|

|

Reynolds | X | X |

| X |

|

|

IP-8. Policies and practices for notifying consumers about ingredients and nutritional information in addition to legal requirements

Labeling Requirements

Regulatory labeling requirements that are relevant to the product market vary, depending on the product category. The specific Official Mexican Standard (NOM) applies to the domestic market. If none exist, general guidelines and regulations apply, such as: Sanitary Control for Products and Services; the General Health Law on Sanitary Control of Activities, Establishments, Products and Services; Agreement for Determining the Additives and Processing Aids in Food, Beverages and Food Supplements, their Use and Sanitary Arrangements; Arrangement to Determine Prohibited or Permitted Plants for Teas, Infusions, and Edible Vegetable Oils, among others.

For export products, we apply the applicable regulation from the country to which they will be exported.

As a voluntary practice that goes beyond legal requirements, we reviewed the sub-ingredients of the raw materials included in the formula to manifest any additive or pollutant that could affect product safety. In addition, we requested results from a pollutant analysis from certain suppliers, depending on the nature of the ingredient or product, especially for those products exported to the United States.

Information on Contents and Ingredients

All of our products in the Food, Non-Alcoholic Beverage and Food Supplement categories include a corresponding list of ingredients and nutritional information.

- For Food and Beverages, it is mandatory to include energy content, proteins, total fat, saturated fat, carbohydrates, total sugars, dietary fiber, and sodium.

- For Supplements, we must include energy content, protein, total fat, carbohydrates and sodium per portion and per 100 g.

The main source of nutritional information is the label. However, some of the Company web pages include that information. In addition, the 01800-customer service line for each of the food and non-alcoholic beverage brands has the corresponding and up-to-date information.

All statements made on the labels must be supported by scientific evidence in order to include them on the lable and in compliance with the regulation that applies to that product and to the market where the product will be sold.

Within these internal guidelines, we have agreed to include the following on the label:

- Whether the coloring is artificial or natural

- If the flavor is natural, artificial, or identical to natural

- Hydrolyzed protein and MSG are declared as is

- There is no statement policy for GMO, in accordance with national legislation

- Sweetening agents are declared, as required by the Additive Agreement

- All present allergens and those that could be present in the product are declared

- Practically none of our products are fortified, unless required by law

- The methods used to process the foods to maintain their safety are listed

417-2. Incidents of non-compliance concerning product or service information and labeling

In 2018, there were 4 incidents related to our product labeling, 3 of which resulted in a monetary fine and one which produced a verbal warning.

HERDEZ CEDIS EL DUQUE: McCormick infusions were immobilized. Product was released for reconditioning.

McCORMICK EL DUQUE PLANT: McCormick infusions were immobilized.

NUTRISA: Product was halted at the branch in Las Américas, Xalapa, and at the branch in San Esteban, Naucalpan, due to finding product at no charge. Product was halted at the Galerías Atizapán branch in the State of Mexico, because of expired product.

416-1. Assessment of the health and safety impacts of products or services

The Research & Development Departments at Grupo Herdez, Helados Nestlé and Nutrisa are responsible, not only for conceptualizing products that anticipate or adapt to changing lifestyles and the needs of our customers and consumers, but also make required modifications in terms of health, safety, quality and nutrition for our broad portfolio of existing products.

Herdez

In 2018, the range of canned vegetables was reformulated with a reduction in sugars and we began to work on reformulating certain products that will be launched in 2019, with the goal of making them healthier.

The reduction of added sugars was applied to different presentations:

- Corn kernels

- Bean salad

- Vegetable salad

- Peas and carrots

- Baby peas

Nestlé

Of our products, 4% were evaluated and improvements were formulated to impact health.

We developed 10 transformation projects in 7 SKUs of the 159 that were marketed in 2018.

- Switched to natural flavors - Nesquik frozen pop, Lápiz de Color, Galactea and Pelapop

- Reduced sugar - Galactea frozen pop, Pelapop, Nieve Lápiz de Color, Carlos V ice cream.

- Reduced calories - Carlos V frozen pop

- Reduced saturated fats - Galactea frozen pop

All of the products that were marketed and manufactured under the Nestlé brand are evaluated under Nutritional Foundation criteria, which define very strict parameters for caloric content (kcal), added sugar (g/portion), total fat (g/portion), saturated fat (g/portion) sodium (mg/portion) and fructose (g/portion). Compliance with these criteria is mandatory for any product intended for children.

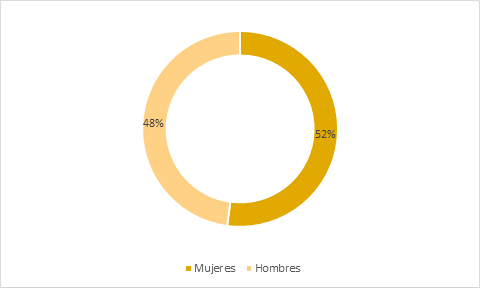

IP-5. Types and rates of injuries, occupational diseases, lost days, absenteeism, and work-related fatalities

Since 2012, the Environmental Control, Health and Safety (CASH) Department operates under a strategic plan to follow-up incidents and prevent workplace accidents and environmental damage.

Thanks to this ongoing effort, in 2018, we reduced our Accident Rate by 19% and reduced the Lost Work Days Rate by 22%.

Year | Gender | Accidents | Accident Rate * | Days lost due to accidents | Days lost due to accident rate |

2018 | Women | 81 | 1.55 | 934 | 17.83 |

Men | 98 | 1.41 | 1,843 | 26.54 | |

Total | 179 | 1.47 | 2,777 | 22.79 |

Year | Gender | Accidents | Accident Rate * | Days lost due to accidents | Days lost due to accident rate** |

2017 | Women | 68 | 1.5 | 1,024 | 22.52 |

Men | 147 | 2 | 2,423 | 33.02 | |

Total | 215 | 1.81 | 3,447 | 29 |

(*) The accident rate expresses the number of accidents during the year in relation to the total man-hours worked multiplied by a factor of 200,000.

(**) The days lost rate expresses the total number of days lost during the year in relation to the total man-hours worked multiplied by a factor of 200,000.

The information shown here covers all Group employees, since the Company does not have subcontracted personnel.

403-8. Health and safety management system

The Environmental Control, Health and Safety Department (CASH) monitors our health and safety management systems. These systems apply to all of the Grupo Herdez facilities, including Plants, CEDIS, Stores and Corporate Offices. Likewise, they cover all personnel working or within any of our facilities.

The Occupational Health and Safety systems are in effect for employees and workers who are not employed by Grupo Herdez.

This training includes all Grupo Herdez personnal as well as workers who are not employed by the company but whose work and/or place of work is controlled by the organization.

Number of Workers | Total Percentage Covered by the SG (%) | Percentage Internally Audited the SG (%) | Percentage Audited/Certified by Third Parties (%) | Observations |

1,527 | 100% | 2-3% | 0% | At all Grupo Herdez facilities, all personnel, whether internal or external, is trained in order to work. All are governed by the Grupo Herdez systems, rules and safety procedures. |

403-7. Prevention and mitigation impacts

Grupo Herdez has an Industrial Safety Policy that applys to any person working or within the Group’s facilities, as well as contracted or subcontracted personnel. The Industrial Safety Policy may be viewed at https://grupoherdez.com.mx/conocenos/codigos-y-politicas/

403-6. Promotion of worker health

Grupo Herdez facilitates worker access to medical and health services. We have the following mechanisms:

Strategy | Scope | Evidence |

File composition | Worker conformity assessment | Staff medical exam |

Medical consultation at Plants | For all workers | Medical consultations and their records |

Integration into internal health campaigns | For all workers, where applicable | Attendance or assessment lists |

Work risk exam | When required to perform a job deemed to be risky | Medical assessment and/or work permit |

Private Institutions | For all workers | Service contracts or purchase orders |

Regulatory Health Studies | Audiometry |

|

In addition, we offer voluntary services and health promotion programs that are not related to work.

Service / Program | Description | Evidence |

Medical guidance in case of illness | The employee must notify his or her immediate supervisor of any anomaly or discomfort to be sent and attended to in the Plant’s medical office, to receive assessment and medical guidance. | Medical leave, care log |

Prevenimss | Prevenimss campaigns to apply vaccines, measure stature, weight, blood pressure, etc. |

|

Seasonal Illnesses | Newsletters to prevent seasonal illnesses in summer, autumn and winter |

|

Get rid of standing water | Campaign to prevent the proliferation of vector-borne diseases such as dengue, zika, among others. |

|

ISEMIM health campaigns | Campaigns for de-worming, breast cancer, prostate cancer, etc. | Photographs, records |

Government hospitals | Prevention campaigns, conferences | Attendance lists, records |

Annual health campaigns | Prevention campaigns for staff on health topics, taught by external personnel, and a visual health campaign |

|

Internal nutrition campaign for personnel in situations involving excess weight and nutritional control | For all workers |

|

Prevenimss campaigns to apply vaccines, measure stature, weight, blood pressure, etc. | For all workers |

|

All employee medical information is strictly confidential. To ensure this is maintained, we apply our Code of Ethics.

If any illegal or unethical situation is detected, all of our stakeholders may report non-compliance through:

- E-mail: [email protected], [email protected]

- E-mail and direct line to the supervisors in the Human Resources, Internal Audit and Legal Departments

- Physical mailboxes in different locations

- Phone line 01 800 CONFIANZA (1 800 266 342 692) or (Nutrisa 01800 312 98 32)

These mechanisms are available 24 hours a day, 365 days a year.

403-5. Training on occupational health and safety

Occupational health and safety training are a main CASH activity.

This training includes all Grupo Herdez personnal as well as workers who are not employed by the company but whose work and/or place of work is controlled by the organization.

Training | Description / List of Topics |

Safety Training | Identification of unsafe actions and conditions, policies, regulations and safety management systems |

STPS Standards | Annual training in applicable standards from the STPS, at the knowledge level for all operational personnel and at the mastery level for specialized personnel, according to the work site, including AR and AST. |

SafeStart | Safety philosophy that promotes a culture of safety by raising awareness among the personnel, producing safety habits that reduce the occurrence of injuries caused by human behavior status, critical errors, and practicing error reduction techniques (5 modules). |

Lock Out / Tag Out (LOTO) | Technical training for lock out systems for essential operating, maintenance and cleaning jobs where personnel are required to intervene in moving equipment and/or that uses electrical power, in order to eliminate dangerous energy sources that could put workers in danger. |

Emergency Response | Training personnel in response activitties for emergencies related to operations such as: natural disasters, firefighting, first aid, evacuations, search, rescue, spill response, sabotage, etc. |

CT PAT | Employer safety (facility safety, personnel safety, training, transportation, reporting culture, information systems, process and internal) |

STOP | Safety process to identify and correct unsafe actions in the workplace |

403-4. Worker participation and consultation

Grupo Herdez has various processes to foster worker participation and consultation in the development, implementation and assessment of the management system. Likewise, they also provide access and to communicate relevant information on occupational health and safety topics to our workers. They are:

Process | Description |

5 S System | This complies with the 5 S system through visible standards and regulations in each area for easy comprehension and identification by all personnel, giving them the power to deny entry to any person who does not comply with the requirements in the standards. |

CASH Notice Boards | Develop the dissemination of information about campaigns, invitations to participate in workplace health and safety activities, and accident rate indicators. |

Comprehensive Management System | Safety patrols and/or audits are scheduled to assess compliance. When needed, action plans are established based on the hazards that are identified. Likewise, feedback is provided for the areas involved for ongoing improvement with good safety performance. |

Notices, newsletters, pamphlets, and visual aids | Production of informative notices with relevant information and scheduled events for topics oh safety, health, and/or the environment |

Health Programs | Based on the contents of the annual health program, different occupational health campaigns are carried out, including vaccination, early detection of chronic-degenerative diseases, studies on occupationally exposed personnel, analysis of febrile reactions and follow-up with medication. |

Mailboxes | Comments and observations may be sent through cards deposited in the physical mailboxes at each location. These mechanisms are available 24 hours a day, 365 days a year. |

We have health and safety management committees to provide timely follow-up for each relevant topic, described as follows:

Committee | Responsibility | Meeting Frequency | Degree of Authority |

Health and Safety Commission | Strategic patrols to identify unsafe acts and/or conditions | Monthly | Medium |

CASH Pillar | Execute and implement safety methodology, participating in the analysis of accidents, actions, and early attention to unsafe conditions. | Weekly | High |

Strategic Plant Committee | Important decision-making on strategic points | Monthly | High |

Environmental Control, Health and Safety (CASH) | Management duties on occupational health and safety | Weekly | High |

In addition, we have formal local agreements with the unions, to benefit the workers, on occupational health and safety such as: emergency brigades, evacuation and firefighting brigades, workplace disease and accidents, health and safety campaigns, workplace risk prevention system, and all those mandated by law, regulation, and the Official Mexican Standards.

403-3. Occupational health services

The definition of participation in Occupational Health (Medical Service) begins in a safety patrol program, which highlights unsafe conditions. Based on the Risk, an annual program is established with general and special tests such as spirometry, audiometry, vibrations, lower and/or elevated thermal conditions, etc.

Medical files are kept strictly confidential and solely for physician-patient knowledge.

403-2. Hazard and risk identification

Identification

The main process for identifying occupational hazards and risk evaluation is through the Comprehensive Environmental Control, Health and Safety Management System (SAI CASH).

This internal system is based on adherence to regulatory monitoring, including preventive observation of conduct. That is why we provide training on the 5 Ss in Job Safety Analysis (JSA).

Monitoring

To ensure proper compliance with SAI CASH, we prepare measurements and indicators that are strategically reviewed on a weekly, monthly and annual basis. From the monthly and annual results, we prepare work plans for the subsequent year, which are approved by local management, CASH management and the Office of the Supply Chain.

Ongoing improvement

The results of the CASH measurements and indicators highlight areas of opportunity, which are established in future work plans. In addition, weekly meetings are held with safety leaders, who present the progress made in timely follow-up for each area of opportunity that was identified.

Reporting Identified Hazards

The main reporting process is through cards left in mailboxes, reports that are documented through verification lists, and through reports by the Health and Safety Commission.

The three reports mentioned above are confidential. A Review Committee is involved in the reporting process, aided by management, which provides specific, case-by-case support.

Policies and Processes in Case of Incidents

Policy / Process | Description |

Preventive Observation System | The hazardous situation is identified and is reported according to its relevance and importance, based on the impact that it could have. Once it has been analyzed, a determination is made as to whether the process requires an operational shutdown until the situation is resolved. |

Industrial Safety Policy | Supported by the commitment of the Head Office Includes topics on safety, health, environment |

5 S System | Standards are visible in each department, along with regulations with the entry standards. If there is a compliance failure at any time, any person may decide to deny into any area backed by the implementation of these programs. |

Accident Investigation /Health and Safety Commission | Once any type of accident is detected, area supervisors or managers are gathered with the Health and Safety Commission to determine its root cause. Once the situation has been reviewed, a news flash is published that specifies the situation, causes, and actions taken. |

403-1. Health and safety management system

The Environmental Control, Health and Safety System (CASH) monitors our health and safety management systems. These systems apply to all of the Grupo Herdez facilities, including Plants, CEDIS, Stores and Corporate Offices. Likewise, they cover all personnel working or within any of our facilities.

The Occupational Health and Safety systems that are implemented for employees and workers who are not employed by Grupo Herdez but whose work and/or place of work is controled by the organization are:

Systems | Standares / Guidelines Used as Basis | List of Standards / Guidelines |

SAI CASH | STPS Standards | NOM-001-STPS-2008, NOM-002-STPS-2010, NOM-004-STPS-1999NOM-005-STPS-1998, NOM-006-STPS-2014NOM-009-STPS-2011, NOM-010-STPS-2014NOM-011-STPS-2001, NOM-015-STPS-2001NOM-017-STPS-2008, NOM-018-STPS-2015NOM-019-STPS-2011, NOM-020-STPS-2011NOM-022-STPS-2015, NOM-024-STPS-2001NOM-025-STPS-2008, NOM-026-STPS-2008NOM-027-STPS-2008, NOM-028-STPS-2012NOM-029-STPS-2011, NOM-030-STPS-2009NOM-033-STPS-2015, NOM-034-STPS-2016 |

WCM (World Classs Manufacturing) | Official Mexican Standards, Industry Best Practices | |

SafeStart | SafeStart | Safety based on behavior |

Work System Based on Direct Observation | STOP | Detection and correction of unsafe actions |

Employer Safety System | CT PAT | Facility Safety, Employee Safety, Personnel Training |

OHSAS 18001 | International standard focused on occupational health and safety topics | List of Official Mexican Standards that are applicable to the business activity as well as international standards focused on occupational health and safety topics |

The above has allowed us to safeguard the integrity and well-being of our operational personnel, prevent and mitigate incidents that could affect the environment, and maintain a culture of safety and risk prevention, thereby guaranteeing the continuity of our operations.

IP-9. Developing a Healthcare and Nutrition Strategy

Within the Technical Division, the Scientific and Regulatory Affairs Department ensures that the products developed by Grupo Herdez contain permissible ingredients in the doses indicated by the Regulations that are applicable to each product category. It also determines which nutritional icons must be placed on each front label, so that customers have the nutritional information for each product.

Likewise, the Technical Division ensures that new and existing products comply with the regulatory framework that is applicable to each product category, ensuring their quality and safety, and in compliance with national and international standards in terms of health and nutrition.

In the innovation, development and reformulation of already-existing products, the recommendations issued by the World Health Organization are taken as a reference in terms of nutrition and healthy eating, for international standards.

At the national level, references are taken from the NOM-086-SSA1 (Non-Alcoholic Drinks and Foods with Modifications to their Composition) and NOM-051-SCFI/SSA (General Labeling Specifications for Pre-Packaged Non-Alcoholic Drinks and Foods).

In 2018, the range of canned vegetables was reformulated with a reduction in sugars and we began to work on reformulating certain products that will be launched in 2019, with the goal of making them healthier.

IP-7. Innovation Management

Innovations for processes are under consideration for future years and will include more sustainable packaging technology.

Expenses in I&D over the past two years has been as follows:

| Unit | 2017 | 2018 | |

Total R&D Expenses | Millions of pesos (MXN) | $13,115,879.21 | $18,112,998.00 | |

Number of R&D positions | FTEs* | 33 | 43 | |

R&D spending as% of sales | Spending MXN / % of net sales from innovation | 5.9% | 7.2% | |

FTEs* full-time employees |

|

| ||

Grupo Herdez seeks to promote open innovation in order to contribute to external knowledge and to supplement our internal I&D strategy. In 2018, our most successful project was Show Off Your Salsa.

Project | Description | Quantitative Impact on R&D Cost/Benefit | Benefit | |

Show Off Your Salsa | Through a promotion, we asked customers to send us their recipes so that the winners could be launched as part of our portfolio of salsas. The recipes were produced by our customers and we received more than 12,000 recipes. | In 2018, we generated 4.2 MDP of sales in 3 months | We produced a positive customer reaction by actively involving them in an innovative process. We have a pipeline of 12,000 recipes for the subsequent years. Increase in household penetration | |

In 2018, the income generated by product innovations, new products and products with significant improvements were:

Percentage of income (in %) | 1.75% |

New products or services marketed during the past year (2018) | 23 |

Products with significant improvements tha were marketed during the past year (2018) | 8 |

Products or services without changes or minimal modifications | Rest of the portfolio |

Total | 100% |

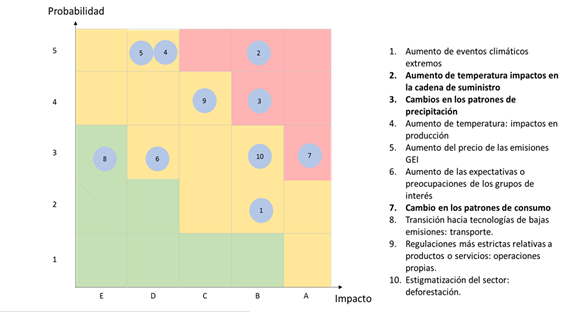

201-2. Financial implications and other risks and opportunities due to climate change

Since we are a leader in the food industry, we have a high dependence on natural resources, especially agricultural supplies and water. Therefore, in order to guarantee the continuity of our operations and continuous growth, it is essential to anticipate and manage the impacts produced by environmental changes.

Therefore, in addition to our environmental actions to reduce our atmospheric emissions and take care of biodiversity, such as reducing fuel consumption and the use of electrical power, we have the Renewable Energy Cogeneration Project, the use of wind energy and the Agricultural Sustainability Plan.

In 2018, we are perfecting our strategy and we present the alignment of our four action pillars with 7 Sustainable Development Goals. They allow us to highlight our environmental priorities: Clean water and sanitation, Responsible Consumption and Production, Climate Action and Life Below Water.

In addition, we continue to work on projects that are highly challenging, but that have great impact on our business strategy: Organizational Life Cycle Assessment and Climate Change Risk Study. Both projects will allow us to identify the key activities with the most impact, the associated business risks, opportunities for efficiency, and to implement corporate planning actions for environmental sustainability.

Both projects will wrap up in 2019.

Organizational Life Cycle Assessment

This tool is used to quantify the environmental impact of a product, service or organization by taking all of the stages in the supply chain into consideration.

This analysis will allow us to identify our main environmental impacts caused by our main products and the areas of opportunity to reduce our ecological footprint, in its various expressions (water footprint, carbon footprint, among others).

Advances

- Plant and CEDIS visits

- Selection of categories and SKUs

- Workshops with agricultural suppliers: identifying available information on the impact, probability and resilience to climate change risks and information requirements.

Universe: Approximately 81% of total production and 49% of SKUs.

Climate Change Risk Study

The purpose of the Climate Change Risk Study is to identify the impact of climate change on the Group’s business continuity. We will use it to prioritize the business risks and perform an assessment of the financial impact to be able to propose manageable initiatives.

Advances

- Identification of risks through a risks and resilience questionnaire given to agricultural suppliers

- Collection of important information - internal and external - on the topic

- Identification of the most relevant risks at the point on the value chain where they could materialize, taking into consideration the probability of occurrence and the impact that could be produced

The identified risks have been classified based on their probability of occurrence and impact, so it is possible to prioritize those deemed most relevant and to inform the decision-making process to manage them in the most appropriate manner, regardless of whether or not they materialize in our own operations, in the supply chain, or in our relationships with our stakeholders.

According to the considerations listed above, the following map presents the main climate change risk factors that have been identified: Increase in temperature and its impact on the supply chain, changes in precipitation patterns and changes in consumption habits.The study is expected to conclude in 2019 and an action plan will be defined in order to manage the identified risks.

IP-6. Agricultural Sustainability Plan

The purpose of the Agricultural Sustainability Program is to generate high quality food products, avoid altering the balance in the environment, use natural resources appropriately and maintain their integrity for future generations.

The main benefits of the Program include reducing costs for our suppliers, reducing environmental impact and producing agricultural raw materials with fewer chemical residues, thus achieving higher quality.

Through the Good Practices Manual, training sessions and environmental audits, we support our agricultural suppliers in their adoption of best labor and environmental practices. In 2018, we held two training sessions on:

- Integrated Crop Management

- Agricultural Sustainability

Audits

In order to provide continuity and validity to our progress in the Agricultural Sustainability Plan, we have a team of six internal auditors who evaluate and monitor the status of the properties. They monitor whether the suppliers are located in environmentally sensitive areas and the measures that are being implemented to protect them, as well as the measures adopted to improve soil quality, increase recycling and reduce waste production. They do this using a checklist that measures progress and improvement points for each supplier.

Our auditors have the Produce Safety Alliance certification.

The producers are audited based on the guidelines contained in the Good Hygiene Practices Manual for Agricultural Products, with two main criteria: Good Agricultural Practices Manual and Agricultural Sustainability Program.

In 2018, 38 suppliers were evaluated against the Good Agricultural Practices criteria and 37 against the Agricultural Sustainability Program criteria.

The main existing controls to monitor advances in the implementation of the Plan are:

- Delivery of documentary control at the beginning of the contract. Frequency: yearly

- Periodic monitoring of each supplier. Frequency: biweekly

- BPA Auditors. Frequency: quarterly

- Water, soil and fruit analysis. Frequency: only once for water and soil; fruit is monthly.

Agrichemical Use

The main objective in reducing the use of agrichemicals falls under the Integrated Crop Management (use of biological products).

Type | % Reduction | |

| 2017 | 2018 |

Pesticide | 10% | 16% |

Of all of our agricultural suppliers, the percentage of compliance with the Good Agrochemical Handling and Useage is:

2017 | 2018 |

60% | 90% |

301-1. Materials used by weight and volume

In 2018, the total of renewable materials, including agricultural raw materials, was:

Renewable Materials (ton) | 2017 | 2018 |

Raw Materials | ||

Corn Oil | 80 | 102 |

Palm Oil | 34 | 45 |

Soy Oil | 104,136 | 109,110 |

Kernel Oil | 847 | 1,002 |

Oils, Fats and Derivatives | 33 | 76 |

Sliced Olives | 2 | 4 |

Acids | 665 | 758 |

Dehydrated Garlic | 261 | 207 |

Alcohol | 646 | 673 |

Almonds | 48 | 59 |

Starches | 3,164 | 2,944 |

Water resin | 1 | 1 |

Sugar | 8,295 | 8,750 |

Cacao | 61 | 72 |

Dehydrated Meat | 28 | 34 |

Dehydrated Onion | 262 | 319 |

Cereals and Fibers | 108 | 128 |

Mushroom Chunks and Slices | 15 | 2 |

Dehydrated Peas | 2,174 | 1,304 |

Dehydrated Hot Peppers | 49 | 57 |

Chocolates | 92 | 112 |

Coatings | 1,113 | 1,080 |

Cocoa | 125 | 131 |

Ice Cream Colors | 107 | 62 |

Dry Colors |

| 82 |

Lemon Juice Concentrate | 384 | 396 |

Fruit Concentrates | 59 | 106 |

Cream for Ice Cream | 109 | - |

Sweetening agents | 15,055 | 17,591 |

Sweeteners | 5 | 13 |

Spices | 199 | 194 |

Stabilizers | 30 | 50 |

Extracts | 8 | 8 |

Frozen Fruit | 100 | 312 |

Dehydrated Fruit | 50 | 92 |

Stabilized Fruit | 160 | 302 |

Frozen Cookies | 2,484 | 659 |

Mole Crackers | 910 | 2,314 |

Jellies | 74 | 100 |

Coconut Oil | 56 | 149 |

Gelatin | 100 | 160 |

Flour | - | - |

Syrups | 262 | 218 |

Liquid Lemon Juice | 100 | 95 |

Powered Lemon Juice | 2 | 2 |

Milk and Milk Products | 1,448 | 1,936 |

Vegetable Shortening | 30 | 33 |

ADB Mixtures | 639 | 544 |

Monoglyceride | 6 | 9 |

Mustard | 1,260 | 1,280 |

Ground Mustard | - | - |

Nut | 25 | 32 |

Oleoresin | 37 | 37 |

Coconut Paste | - | - |

Tomato Paste | 19,740 | 17,395 |

Pectin | 24 | 26 |

Cucumber Bites | 100 | 99 |

Peppers | 121 | 111 |

Polydextrose | 186 | 189 |

Vitamin Premixtures | 21 | 24 |

Vegetable Protein | 205 | 185 |

Chemicals | 679 | 617 |

Ice Cream Flavors | 278 | 35 |

Dry Flavors |

| 300 |

Refined Salt | 6,238 | 6,277 |

Salts | 67 | 10 |

Wheat Bran | 586 | 537 |

Seasonings | 12 | 36 |

Seeds and Cereals | 107 | 256 |

Semolina | 73,641 | 73,534 |

Textured Soy | 60 | 87 |

Tea | 120 | 87 |

Toppings | 103 | 328 |

ADB Sales - Chile Peppers | 13 | 14 |

ADB Sales - Ground Mustard | 720 | 662 |

ADB Sales - Peppers | 92 | 76 |

Vinegar | 2,581 | 2,902 |

Vitamins and Minerals | 0 | - |

Egg Yolk | 10,347 | 10,802 |

Powdered Egg Yolk | 1 | 0 |

Megamex Salsa Project |

| 87 |

Wonka Projects |

| 75 |

Total | 261,979 | 268,494 |

|

|

|

Agricultural Raw Materials | ||

Tomato for puree | 46,342 | 57,434 |

Tomatillo for salsa | 3,149 | 3,536 |

Jalapeño chili pepper | 3,795 | 3,449 |

Onion | 272 | 309 |

Carrot | 3,135 | 2,727 |

Sweet yellow corn | 21,613 | 17,050 |

White corn | 345 | 291 |

Chickpea | 133 | 128 |

Potato | 694 | 589 |

Green bean | 435 | 307 |

Dry chipotle pepper | 522 | 486 |

Tomato for salsa | 11,712 | 10,205 |

Tomatillo for salsa | 8,192 | 8,649 |

Onion | 3,155 | 3,027 |

Jalapeño chili pepper | 1,904 | 1,774 |

Cilantro | 424 | 380 |

Prickly pear cactus | 2,829 | 2,813 |

Ancho chile pepper | 701 | 688 |

Pasilla chile pepper | 701 | 653 |

Sesame | 1,699 | 1,643 |

Peanut | 1,329 | 1,214 |

Pumpkin seed | 279 | 209 |

Serrano chili pepper | 42 | 67 |

Avocado pulp | 497 | 547 |

Chipotle chili pepper | 42 | - |

Fresh ancho chili pepper | 2,036 | 1,695 |

Fresh pasilla chili pepper | 1,351 | 2,456 |

Frozen whole strawberries 27+1 | 1,139 | 1,088 |

Frozen sliced strawberries 27+1 | 1,192 | 1,068 |

Frozen sugarless strawberry puree | 470 | 997 |

Whole blackberries 4+1 | 270 | 343 |

Whole sugarless blackberries | 2 | 13 |

Blackberry puree 4+1 | 128 | 267 |

Ground pineapple 4+1 | 102 | 177 |

Frozen apricot chunks with sugar | - | 161 |

Whole raspberries 4+1 | 4 | 8 |

Raspberry puree 4+1 | 6 | 8 |

Sugarless rasberry puree | 0 | 6 |

Apple chunks 4+1 | - | - |

Standardized sliced strawberries | - | 25 |

Orange strips | - | 10 |

Strawberry seed | 7 | 11 |

Grape Concentrate | 1 | 6 |

Mango chunks | - | 10 |

Aseptic apple pulp | 8 | 19 |

Hawthorn puree | 1 | 22 |

Peach chunks 4+1 | 12 | - |

Peach pulp 4+1 | - | 10 |

Coastal honey | 958 | 1,337 |

Highland honey | 286 | 544 |

Chamomile tea | 543 | 728 |

Lemon tea | 126 | 273 |

Mint tea | 64 | 109 |

7 Blossom tea | 30 | 59 |

Hibiscus tea | 27 | 28 |

Linden tea | 45 | 15 |

Total | 122,752 | 129,666 |

Total MP + MPA | 384,730.46 | 398,159.57 |

Renewable material: renewable materials from abundant sources that are quickly replaced during ecological cycles or agricultural processes, in such a way that these and other related resources are not threatened and will be available for the next generation.

* Due to the traceability and effectiveness of the measurement of our packaging materials based on the number of resources and different purchasing units, starting in 2017, there is no report for the total volume of packaging material used.

IP-4. Environmental investments

Line item | Monetary Investment | Percentage | Description | ||

2017 | 2018 | 2017 | 2018 | ||

Reduced Carbon Footprint | $ 485,600.24 | $ 389,480.50 | 1% | 1% | Investment made for the Organizational Life Cycle Assessment (OLCA), which determines the carbon footprint for the Company’s main product categories |

Reduction of CO2 emissions (reduction of air emissions) | $ 8,088,622.98 | $ 2,014,169.43 | 18% | 6% | Investment made by the Group’s facilities to treat air emissions (installation/maintenance of anti-pollution equipment) |

Reduction of Water Emissions (waste water treatment) | $ 20,230,484.27 | $ 12,846,028.16 | 44% | 41% | Investment in waste water treatement systems at Group facilities |

Reduction of GHG emissions | $ - | $ - | 0% | 0% | No evidence of investments to reduce GHG emissions |

Reduction of Waste (post-Industrial waste handling) | $ 8,112,381.43 | $ 8,381,882.47 | 18% | 27% | Total cost of adequate disposal of non-valued waste |

External Consulting Services | $ 1,888,137.50 | $ 1,668,110.43 | 4% | 5% | This cost includes:a) External environmental management servicesb) External certifications in environmental compliancec) Consulting services for developing the Environmental Management System (SiGA) model |

Anti-Pollution Equipment | $ 154,828.92 | $ 156,105.52 | 0% | 1% | Investments in anti-pollution equipment (PTAR, PTAN, gas scrubbers, sludge trap, filter press, dust extraction, etc.) and other projects for environmental purposes |

Green Purchases | $ 15,400.00 | $ 101,550.00 | 0.03% | 0.3% | Expenses incurred for ecological purchases and/or development of environmental awareness events |

Post-Consumer Waste Management | $ 529,316.76 | $ 535,339.09 | 1% | 2% | Total cost for integrated post-consumer PET waste management, implemented through ECOCE for collection, valuation and integration into new production chains (circular economy) |

Participation in Industrial Organizations and in Environmental Sustainability Fora | $ 265,238.18 | $ 369,694.94 | 1% | 1% | Payments to environmental associations, conferences, participation in trade fairs or expos, various fees, etc. |

Hiring specific personnel | $ 525,469.97 | $ 2,299,433.45 | 1% | 7% |

|

Other Items | $ 5,798,084.28 | $ 2,371,222.43 | 13% | 8% |

|

ANNUAL TOTAL | $46,093,564.53 | $ 31,133,016.42 | 100% | 100% |

|

* The reported information only includes the amounts reported by the Group’s facilities as environmental investments for environmental control and management in their processes. It also includes the amounts that the Environmental Sustainability department allocates for the payment of various environmental activities that it carries out.

** The information does not include data from the CAPEX investments that the Group makes for large-scale projects.

308-1. New suppliers that were screened using environmental criteria

In 2018, we did not audit new suppliers; however, the traceability of our raw materials and our relationship with our suppliers is essential to guaranteeing that our products reach our consumers’ tables with the quality we are known for.

That is why, regardless of the type of product or service they offer, all of our suppliers must sign and conform to the Code of Conduct for Suppliers, which describes the minimum social and environmental requirements they must meet, and evaluates their compliance with labor standards and current environmental legislation. In 2018, 175 new suppliers signed the Code.Agricultural Sustainability Plan:

Through the Good Practices Manual, training sessions and environmental audits, we support our agricultural suppliers in their adoption of best labor and environmental practices. In 2018, we held two training sessions:

Topic | Location | Number of Suppliers Trained |

Integrated Crop Management | Los Mochis and San Luis Potosí | 39 |

Agricultural Sustainability Workshop | Los Mochis and San Luis Potosí | 43 |

Audits

In order to provide continuity and validity to our progress in the Agricultural Sustainability Plan, we have a team of six internal auditors who evaluate and monitor the status of the properties. They monitor whether the suppliers are located in environmentally sensitive areas and the measures that are being implemented to protect them, as well as the measures adopted to improve soil quality, increase recycling and reduce waste production. They do this using a checklist that measures progress and improvement points for each supplier.

Our auditors have the Produce Safety Alliance certification.

The producers are audited based on the guidelines contained in the Good Hygiene Practices Manual for Agricultural Products, with two main criteria: Good Agricultural Practices Manual and the Agricultural Sustainability Program.

In 2018, 38 suppliers were evaluated against the Good Agricultural Practices criteria and 37 against the Agricultural Sustainability Program criteria.306-2. Waste by type and disposal method

Total weight of waste generated, by type

| Type | 2018 | 2017 |

(Tons) | (Tons) | |

Hazardous waste | 90 | 133 |

Non-hazardous waste (except waste water) | 34,142 | 36,722 |

Total waste generated | 34,231 | 36,855 |

Total weight of waste generated, by elimination method

| Elimination Method | 2018 | 2017 |

(Ton) | (Ton) | |

Recycling | 49 | 61 |

Other (final disposal) | 41 | 73 |

Total | 90 | 134 |

Total weight of non-hazardous waste, by elimination method

| Elimination Method | 2018 | 2017 |

(Ton) | (Ton) | |

Recycling | 23,867 | 27,183 |

Other (Landfill: includes special handling waste and non-valued urban solid waste) | 10,275 | 9,540 |

Total | 34,142 | 36,723 |

Total weight of waste generated, during the last 4 years

Discarded Waste (incinerated, landfill) | Unit | Year 2018 | Year 2017 | Year 2016 | Year 2015 |

Total waste | Metric tons | 34,231 | 36,856 | 40,999 | 30,596 |

Scope of information | % | 85 | 85 | 85 | 85 |

Despite the fact that certain Plants established waste reduction goals, environmental goals were not established for the Group nor by Division. With the SDG strategic alignment, our short-term objective is to establish goals.

306-1. Water discharge by quality and destination

Discharge streams (water discharge) | Volume (m3) | ||

2018 | 2017 | 2016 | |

Discharge into federal drainage | 513,425.00 | 500,595 | 217,559 |

Discharge into municipal network | 284,879.58 | 515,939 | 428,167 |